ESG = Emperor Sans Garments(?)

The consensus ESG investing movement provokes an inverse "Anti-ESG" reaction. Human progress through capitalism is a series of messy tradeoffs. Wise investors look inward for "fairness" and virtues.

“Investing is messy. You know that badly managed companies often deliver higher returns than well-managed companies. That sounds weird until you realize that if everybody thinks a company is well managed, they are going to push up the price. The price you pay will then reflect the management. And all you can then have is a negative surprise. Whereas if you invest in a company where investors think the management ‘can’t chew gum and walk at the same time’, the fact that they can do both is a positive surprise.”

— Aswath Damodaran, Professor of Finance at the Stern School of Business at New York University, on ESG (Environment, Social, Governance) Investing at the 2022 Code Conference

“Quality” At Any Price Versus Quality-Adjusting Prices

The above quote applies well to biases that stock market investors easily get caught in:

We may grow too fond of the most popular “quality” investments of the day. We may forget that no risky, longer-term investments are ever unstoppable “sure bets”. If we then overpay for or oversize such positions too grossly we rely completely on a "bigger fool" to bail us out.

And some very poor quality, poorly managed listed enterprises may return great shareholder value. But likely only if bought at depressed enough prices, with some potential upside catalysts.

We may buy both “high-price tag” and “low-price tag” businesses, measured by for example P/E ratios. But we are value investing only when we judge that we risk capital at price discounts to intrinsic value.

ESG = Emperor Sans Garments(?)

Let's go beyond PiggyBack’s single-minded focus on money-making and learning from value investing. Aswath Damodaran’s full presentation covers issues of capital allocation for society. Your Analyst recommends it for three main reasons:

ESG—Environmental, Social, and Corporate Governance—Investing is sold as a one-size-fits-all “solution” to hard-to-solve issues. These widely adopted institutional frameworks affect the long-term capital allocation of businesses and states. To ignore ESG is to ignore a powerful driver of capital flows.

ESG has become political. At this point, there is now a conservative “Anti-ESG” movement and even themed investment products.

Professor Damodaran delivers rational, wise, and unpopular criticism. To both ESG embracers and Anti-ESG provocateurs. The key question: Does the current idea of ESG as a “goodness” investing framework even make sense?

So, if you have not already watched the presentation, go full screen for 18 minutes:

Good Optics of Capital and Wise Uses of Capital

Economics is supposedly the art of rational allocation of limited resources. With one-size-fits-all ESG bureaucracies, we hand over a great deal of power over our societies’ scarce long-term capital. To no-skin-in-the-game advisors and consultants of politics and big business. Actors who reliably will want to respond to populist calls for whatever short-term, “looks good” action.

Examples of ESG controversies closest to mind for Your Analyst are in the Capital Markets and Asset Management industries:

ESG/Sustainability Investment "Research"

Imagine designing an ESG research framework.

Base it on some unarguably “good” but purposefully vague and very long-term vision or set of goals. Aggregate consultant insights on all the latest buzzwords and rating indices data to convince customers. Include metrics boxes covering environmental ("E"), social justice ("S"), and corporate governance ("G").

ESG rank/rate investments with the boxes. Convert sets or lists into “green”, “sustainable” and/or “stakeholder friendly” investment products.

Based on the indicated lower “ESG risk”, set these products’ prices higher at lower expected gross returns. Lower expected net investor returns even more by charging higher fees (refer to "proprietary" box ticking).

A Hypothetical

Would retirees say “Yes, of course!” if their retirement plan asked in clear terms:

“Would you like to be charged more for less as long as we provide you marketing material showing reduced ‘ESG risks’? You will do future generations a service!”

This exercise easily becomes self-justified box-ticking.

"Divestitures"

ESG has led to several industries becoming excluded or “uninvestable” when it comes to accessing institutional financing at attractive terms in public markets.

For example, fossil fuel energy. Productive and legal but ESG controversial energy assets of this industry are divested. In practice, this means that managements and boards of public companies just sell off unpopular assets to for example private equity interests at low prices. It is done in consideration of an undefined wider set of “stakeholders”, rather than for the shareholders to which the board has a fiduciary duty.

Oil, gas, and coal have clear pollution downsides. Many of us envision a future world that does not need to consume such resources. Near-term reality: The global economy still needs fossil fuels, until it does not. Environmentally bad, but a fact unless we willingly reduce standards of living for a few decades.

The result? Assets of the most criticized industries are predictably moved from high transparency to low transparency owners and operators. At the cost of public shareholders. To the benefit of ESG arbitrageurs, like private equity. The big irony? Basically, the same institutional capital pool pretends that just because it washes its hands from holding these investments via public companies, it can continue to make them via offshore private equity funds.

So how “good” is it this ESG “divesting”? The assets in question will still be productive until outlawed or being made uneconomic by competition from other solutions.

Consulting The Bathroom Mirror

The world is extremely unfair in terms of life opportunity outlook based on where, when, and to whom we are born. With globalism, access to opportunity improves, but it does so slowly and in a free, liberal world we can still never agree fully on “fairness”.

As opportunistic value investors, we can consider investing in “ESG risk premium” by:

Observing developing “uninvestable” themes that are becoming excluded by ESG. Follow capital outflows and increasing costs of capital to lower valuations.

Readers who invest other people’s money are responsible for agreed-on ethical considerations. These may exclude some, but not all “ESG risk” investments.

With unconstrained capital, for example our own, we have a great responsibility to ourselves and the world. Here we can ignore optics and ratings. Instead, we must face the mirror and confront our conscience. Is this potential “ESG risk” investment in an activity that we want to or can even tolerate supporting?

What is certain is that everyone will certainly not agree on subjective issues of morality.

Well-Regulated Capitalism

As for the bigger issue of how the free capitalist world allocates capital. The costs of unproductive or sub-optimal long-term investing made in the name of ESG are borne by society. Externalities, to use the economists' vocabulary.

As a society, we may of course reach a consensus to allow, restrict or outlaw some business or government practices. Well-calibrated and restrained technical regulations that are built up and reformed slowly over time are likely a better practical solution to any E, S, G, or other major problem areas than trying to “codify” morality. Combining regulation with a willingness to trade goods, skills, and ideas despite differences in beliefs has led to great human progress historically.

So short-term pessimists on political games and virtue signaling, long-term optimists on human ingenuity?

PS: Sign up for Aswath Damodaran's very underfollowed, free Substack newsletter “Musing on Markets”. Like the Professor's website, it is a goldmine of investment-related wisdom, valuation models, and data:

Strategy: Cool Bear Market Heads Prevail

Value investing in bear markets requires keeping a cool head.

Initially, a cool head not to buy. Here we must avoid relative “value” trades that only anchor on percentage drawdowns from peak valuation, or on relative multiples versus peer investments. But also value traps, with deteriorating absolute fundamentals and no clear catalysts.

Eventually, a cool head if we reach truly depressed valuations, in absolute and intrinsic value discount terms. There we need it to buy bargain opportunities as aggressively as allowed for by risk mandates and prudence.

Most human investors will make errors of both (1.) commission and (2.) omission. Our emotions and market sentiment become less reliable during periods of more extreme price movements. As value investors, we can try to reduce making large errors in stressed markets by reducing the puzzle to good old boring fundamentals.

Affiliate Marketing: This article section contains affiliate marketing links, labeled “(paid link)".

PiggyBack Promotes: TIKR Terminal

Supercharge your single stock investing with a powerful, yet light Equity Research terminal. TIKR Terminal provides professional and do-it-yourself investors with global, well-laid-out fundamental company overviews. In a fast, easy-to-use, and reasonably priced web app. Think of it as your 24/7, first-look analyst.

PiggyBack’s Value Elsewhere

Free value investing content and other recently enjoyed curiosities with “shelf-life”.

Listen:

The Illusion of Knowledge (~53 min)

“Clearly, Buffett’s name goes at the top of the list of investors who’ve succeeded by shunning macro forecasts and instead focusing on learning more than others about ‘the micro’: companies, industries, and securities.”

Howard Marks, Co-Chairman of Oaktree Capital, on why most of us active, fundamental investors cannot rely on macroeconomic forecasting (Recommendation).

Reads:

Entering the Superbubble’s Final Act (~10 min)

“If the bear market has already ended, the parallels with the three other U.S. superbubbles – so far so strangely in line – would be completely broken. This is always possible. Each cycle is different, and each government response is unpredictable. But these few epic events seem to act according to their very own rules, in their own play, which has apparently just paused between the third and final act. If history repeats, the play will once again be a Tragedy. We must hope this time for a minor one.”

The quote is from Jeremy Grantham, co-founder & Chief Investment Strategist of GMO, in a piece on the U.S. stock market development in this summer of 2022. The summary: a bear market rally from the continued bursting of a historical valuation “superbubble” (with weakening fundamentals).

While not a precise forecast for market timing, do not ignore historically treacherous stock market conditions as doomsaying. Think of it as more of a risk-reward map indicating that “the bang for the buck” is yet in not broad U.S. stocks.

A Taxonomy of Drawdowns (~10 min)

Deep bear markets push most broad stock portfolios into a sea of red. In some sense, a drawdown from previous market value peaks to lower troughs is just a repricing under uncertainty. But drawdowns of course relate to business and financing fundamentals playing out differently than what the consensus recently imagined.

Here fellow Substack publisher Byrne Hobart of The Diff takes a step back to present a stock market drawdown “taxonomy”. In Your Analyst’s view, this three-category framing catches many of the drawdown risks and opportunities that are longer-term relevant for us fundamental value investors.

The Illusion of Knowledge (~10 min)

See Listen above.

Charts:

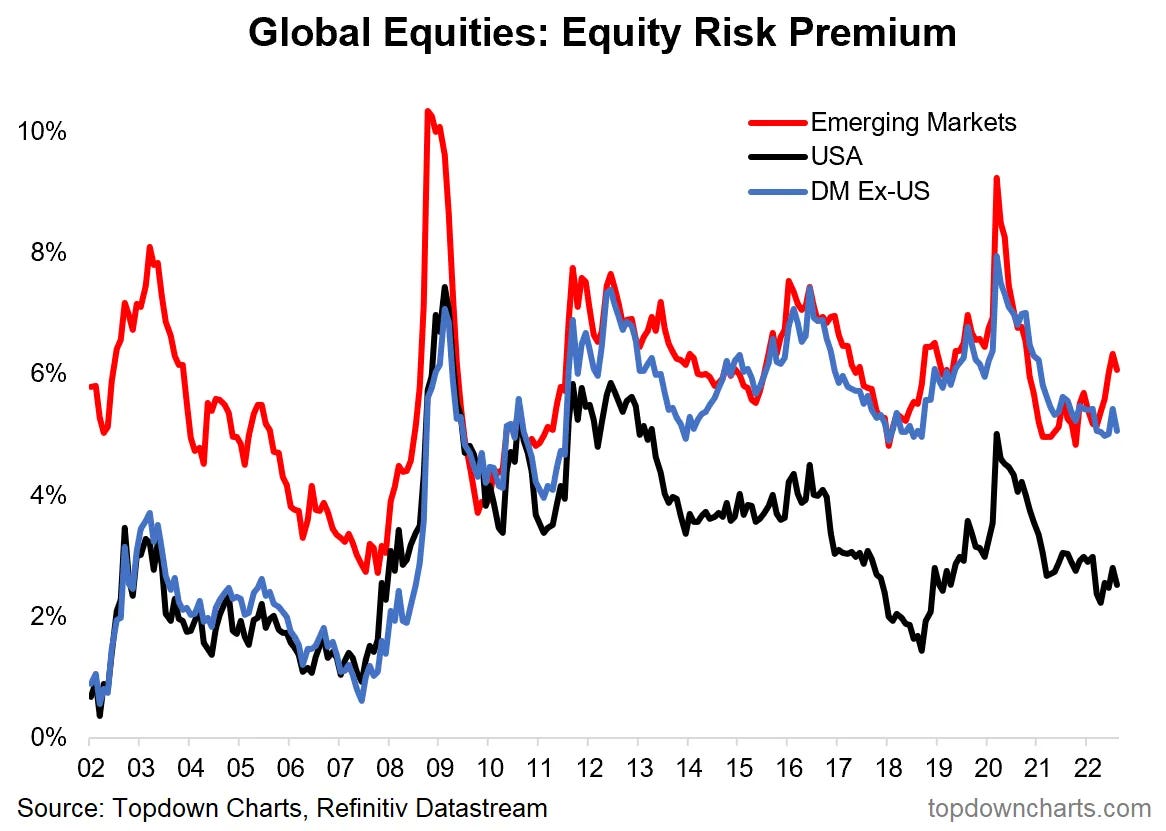

Chart of the Week - Global Equity Risk Premium (~2 min)

Stocks represent ownership in company profits, a residual left after deducting all other claims. To value stocks, we discount uncertain future cash flows back to today (present value) using a discount rate. The simplest possible cost of equity discount rate adds:

(1) “Risk-free” long-term government bond rate in the relevant currency, to compensate for the time value of money. Currently, rising government bond interest rates are increasing this cost of equity. This mechanically lowers valuation multiples.

(2) Equity Risk Premium (ERP), to compensate for all other equity risks. The following chart, by Callum Thomas’ paid publication Topdown Charts, points out how ERPs have not yet really increased to the elevated levels seen around recent decade bear market index trough levels:

“The current level of the ERP is not particularly attractive for US equities. Even the rest of the world, while boasting a higher ERP vs the USA, still hasn’t moved up to previous major buying opportunity levels at this point.”

— Callum Thomas, Head of Research and Founder of Topdown Charts

Mr. Thomas also publishes the free The Weekly S&P500 #ChartStorm, a PiggyBack Recommendation:

DISCLAIMER: This publication and all related communications are for informational and educational purposes only. All readers are assumed to accept the full version of this disclaimer, available at the following link.

Back PiggyBack(!)

Your Analyst sincerely hopes all readers enjoy and get inspiration and value investing ideas from PiggyBack. If so, consider sharing PiggyBack with friends and colleagues:

Only with the help of early readers will this publication reach a sustainable scale for free, independent insights. Many thanks to all PiggyBackers!

Johan Eklund, CFA

PiggyBack

PS: Feel very free to (1) follow 📻, (2) share/tag 📢, and (3) discuss 💬 PiggyBack content, with us and others in relevant threads/groups/hashtags on these platforms:

I do think the media and index funds does cloud the value of ESG. If Elon Musk says ESG is a fake movement, does that mean it really is? Being that Tesla itself is mostly in a bubble, it does make one wonder.

Truly excellent topic choice.